4 Ways the Kiddie Tax Can Work for You and Your Family

The Kiddie Tax, enacted as a result of the Tax Reform Act of 1986, was originally put in place to prevent wealthy parents from shifting income producing securities to children who are in lower or zero tax brackets. This seemingly negative intent of the law has led to a lack of awareness of income shifting strategies that remain available to families and that can be a powerful tax-savings tool when implemented over a period of years.

The Kiddie Tax law establishes rules for taxing income earned by children under the age of 18, and full-time students aged 18-24 who are claimed as dependents of their parents. If these children have “unearned income” exceeding $2,100 in 2018, that income is taxed at their parent’s top marginal tax rate if the parent’s rate is higher than the child’s. Any earned income (think summer lifeguarding job) is taxed at the child’s tax rate.

Unearned income is defined as interest, dividends, capital gains (including mutual fund gains distributions), rent and royalties. It also includes taxable social security benefits, pension and annuity income, taxable scholarship and fellowship grants not reported on Form W-2, unemployment compensation, alimony, and income (other than earned income) received as the beneficiary of a trust.

How the new tax law affects the Kiddie Tax

Trump’s Tax Cuts and Jobs Act keeps the general concept of the Kiddie Tax in place but implements some significant modifications. The potential good news is that, beginning in 2018, children’s excess unearned income will no longer be taxed at the parent’s marginal rate. Instead, incremental amounts over $2,100 will now be subject to the same tax brackets and rates as Estates and Trusts.

The bad news: the new tax law treatment could mean even higher taxes because the Trust and Estate tax brackets are more compressed than rates for married individuals. What that means is trusts reach the highest tax bracket of 37% sooner when taxable income exceeds just $12,500. Under the new tax laws, married couples would pay less than 37% tax so long as their income falls below $600,000.

The new tax law also aims to help families by increasing the standard deduction to $12,000. So, the key to maximizing the standard deduction for dependents is having earned income. Although wages are subject to withholdings for Social Security taxes (6.2%) and Medicare taxes (1.45%) and may also be taxable in your resident state, anyone can earn wages up to $12,000 without paying Federal income tax.

Unfortunately, if your children fall into the kiddie tax regime, they remain subject to the kiddie tax standard deduction limitation which is the greater of $1,050 or earned income plus $350, up to the $12,000 threshold.

Making the Kiddie Tax Work for You

1. Manage your children’s unearned income

So what planning can be done around Kiddie Tax for 2018? That depends on many factors with the most important ones being the covered child’s total earned and unearned income and their parent’s tax bracket. Recognizing that these two factors change over time, you also will want to revisit the issue of Kiddie Tax when there are significant changes in income for you or your children.

Getting started is as simple as reviewing assets titled in the names of your children. You’ll want to check how assets are allocated and see if it makes sense to invest in those that pay qualified and capital gain dividends which are taxed at lower rates. Some ideas here include buying value or growth equity mutual funds or tax-exempt bonds as an alternative to an allocation that generates substantial interest income which is taxed at ordinary income rates.

On an annual basis, you’ll want to determine whether you have the potential to harvest losses to offset realized gains. Keep in mind that capital losses cannot reduce gains below zero and that only a maximum of $1,500 of losses can be used to offset other ordinary income.

At tax preparation time, you may want to utilize a special tax election allowing parents to report their children’s income directly on their tax return. This election is limited to children who have no earned income. In other words, their income is solely from interest and dividends with no capital gains. Additionally, their total gross income must fall above the limited standard deduction of $1,050 and below $10,050. If your child qualifies, the election may benefit you so long as your tax bracket is lower than the bracket pertaining to Estates and Trusts. Given the complexity in this rule, we’d suggest consulting with a CPA to decide whether this election would benefit you

2. Provide your children tax-free earned income

The recent increase in the standard deduction provides some interesting planning opportunities when children are old enough to work. One option here is to pay your child a wage and have that income fall in a range that makes it non-taxable due to the offset of the standard deduction.

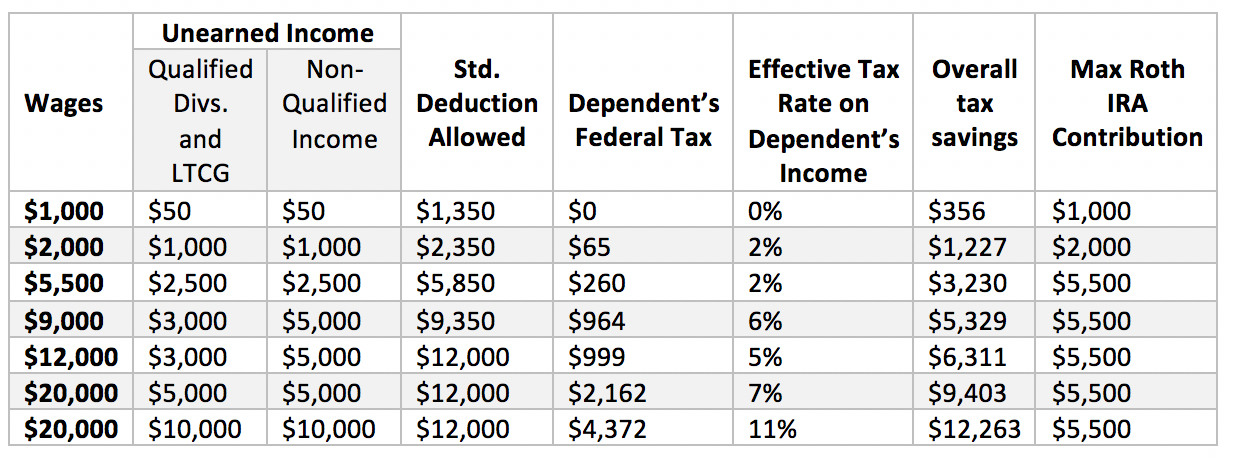

We see this option used most often by parents who own a business and who also fall into a high tax bracket. For example, let’s look at a family with one parent working as a sole proprietor generating $800K of income during 2018. The couple’s investment income consists of $25,000 of qualified dividends and $30,000 of non-qualified dividends. This family would benefit from a total tax perspective by shifting income to a child via paying wages while also gifting securities that generate unearned income. The chart below shows the potential impact of implementing these two ideas.

What this example shows is that a child could be paid wages of up to $12,000 with $0 tax on that earned income because of the standard deduction offset. Meanwhile, their unearned income gets taxed at the Estate and Trust tax rates.

Looking at the big picture, this illustrates the potential to have a child generate a combination of earned and unearned income totaling $40,000 with an effective rate of only 11%!

This is a powerful tax-saving tool when you consider the alternative of leaving all that income allocated to parents where it may be taxed as high as 37% (plus the potential for the 3.8% net investment income tax). On top of lower total income taxes, if parents own a sole proprietorship or partnership with both parents as partners, wages of their employee child are not subject to social security, Medicare, or FUTA taxes.

While considering income shifting, there are a few general rules to keep in mind. First, wages paid to your children must meet a reasonableness test for the tasks they are performing. Next, make sure you consider state tax impacts before shifting income. When calculating potential taxes, remember that the $12,000 standard deduction is used against earned income first, then it can potentially wipe out $350 of investment income after that. Finally, once a dependent’s unearned income hits the $2,100 trigger, they will be stuck with the Estate and Trust tax brackets for all unearned income.

3. Start their investment account when they’re young

Having earned income also means children have the potential to start building their retirement nest egg by making Roth IRA contributions. Kids can put away up to $5,500 of earned income into a Roth IRA annually. Roth IRAs are great because the future growth can be taken out at retirement free of income taxes. And savings in retirement accounts currently does not count against you when applying for college financial aid.

4. Gift stocks to save on capital gains tax

Gifting zero- or low-basis stock to charities is a great income tax savings tool. The same goes for gifting appreciated stocks to children, so long as you are aware of gift tax limits and the Kiddie Tax. For example, if you’re in a high bracket and plan to liquidate assets for child-related expenses like private school or college tuition, it may make sense to gift securities over a period of years. You can save on total capital gains taxes paid so long as you take those gains with an understanding of the Kiddie Tax limits. In the end, unearned income taxed at the Estate and Trust rates is not necessarily a bad thing if parents are paying taxes at even higher rates (i.e. are subject to AMT or 3.8% Net Investment Income Tax). And any low-basis securities with either qualified dividends or that are sold with long-term capital gains will still receive favorable tax rates.

Shifting income is a powerful tool to consider. The 2018 Kiddie Tax and the enhanced standard deduction for dependents may make it a viable strategy for those who are already or may be filing tax returns. Part-time work can be a great way for kids to earn a few extra bucks, and if you can get your kids to contribute a Roth IRA every year while they are still eligible, the time-value of tax-free growth within the Roth IRA may add up to significant future savings. Every tax situation is unique, so make sure to review these tax planning strategies with your advisor.