Legacy Series: Thoughts On Philanthropy

At the Colony Group, our mission is to deliver peace of mind to our clients and to empower their visions of tomorrow. A component of how we achieve our mission is through our Net Positive Pledge, a commitment to being a net positive company, giving more to the world than we take. The underlying trust you place in our firm is founded on our aligned interests and pursuit of excellence in everything that we do. When it comes to advising on your philanthropic vision, we view this as one of the cornerstones of your legacy.

Your Family Legacy

How will you leave your mark on the institutions that matter most to you, your family and to your community? How do you leverage your charitable endeavors and build an enduring legacy? Are you creating unintended dependencies in your charitable endeavors? Are you confident that your giving will have high impact on the targeted population?

To help you frame your thinking around these questions, we offer Threshold Questions for Philanthropy and suggested ways to have more impact for your philanthropic capital.

Threshold Questions for Philanthropy

What are the societal needs or challenges that you are most passionate about?

- Provide lead charitable contributions that meaningfully advance the goals of the charity.

- Provide matching gifts, which have demonstrated success in energizing campaigns and leveraging the gifts of others.

- Be a consistent and reliable supporter of the charities you most want to support.

Are you focused on creating change in any particular specialty, area, or region?

- How do you want to have an impact? Who are the influencers?

- Do you want to align with others, or do you want to be the catalyst?

- Do you want your name associated with a particular organization? If so,

- What responsibility do you have? How much due diligence should you do?

Have you thought about impact investments?

Impact investing is not an asset class in itself, but rather a theme that can be applied across them. However, many impact opportunities take the form of Alternatives such as private equity, debt or pay for performance programs. The risk-return profile varies across investment vehicles and there are a wide range of opportunities that prioritize impact and return in different ways. Many impact investments have unique return profiles that actually provide diversification from traditional asset classes.

Are you focused on creating outcomes with a specific project, or funding organizations whose missions are aligned with yours?

Impact investing is not an asset class in itself, but rather a theme that can be applied across them. However, many impact opportunities take the form of alternatives such as private equity, debt, or pay for performance programs. The risk-return profile varies across investment vehicles and there are a wide range of opportunities that prioritize impact and return in differentways. Many impact investments have distinct return prof les that actually provide diversifi cation from traditional asset classes.

Leveraging your philanthropy and impact investing

There are many opportunities available today to leverage your eleemosynary goals. Here are nine examples.

- Traditional philanthropy – support for all good causes – education, medical, religious, and environmental by supporting yearly operating funding, which is critically important; can be

enhanced with matching gift programs for more participation and impact. - Grant making – review and support worthy organizations with clear needs and hoped for outcomes. Donors can be proactive and bring innovation to the process.

- Pay for Performance – Social Impact Bonds – PFP is a public private partnership that funds effective social services through a performance-based contract. PFP mobilizes capital to drive social progress through more effective policy, better allocation of capital and increased probability of better outcomes.

- Income-Share Agreements – an innovative alternative to student loans. Investors back students and receive a return from income-share agreements. This was first used for engineering students and is now being developed for vocational students.

- Foundation funded venture capital – foundations that have specific objectives can gift part of their 5% required giving to venture capital that supports a clearly aligned goal.

- Building Legacy Impact Vehicles – “purpose driven communities of practice” enables likeminded individuals and organizations to leverage resources to achieve better outcomes for a broader community or communities.

- Private Placement Variable Annuity – an interim investment vehicle, which allows capital to grow tax free until such time as the donor decides to gift to their foundation tax free at a point in time in the future. Provides tremendous optionality.

- Venture philanthropy – “the new philanthropy”, a creative, higher-risk approach to achieving greater scale and more impactful outcomes. The focus can be on social innovation, social entrepreneurship, and catalysts for greater change.

- Family trusts- have varying degrees of flexibility around philanthropic giving. This is trust specific but can provide future flexibility and include other family members in the process.

Opportunities to achieve tax and societal benefits from real estate investments

- Qualified Opportunity Zones – low-cost basis investments can be realized, and the proceeds applied to designated QOZ projects for tax deferred or in some cases tax free returns within specified guidelines. QOZ’s are designated low-income communities that need capital infusions to provide better outcomes broadly defined.

- Commercial PACE loans – Commercial Property Assessed Clean Energy loans – are used to pay for clean energy solutions for new and remodeled real estate buildings. They are structured as a tri-party agreement among the borrower, lender, and municipality.

A Final Thought

What is your life purpose? How do you want to define your legacy? Are you driven by the past or drawn to the future? Let us know how we can help.

Important reminder – The Colony Group does not provide legal advice. Before you consider any of these suggestions, you must seek legal and tax advice.

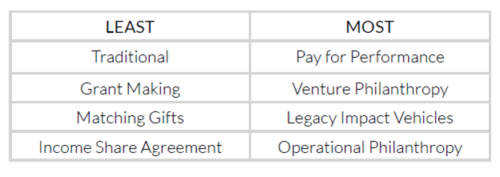

Philanthropic Continuum Based on Degree of Impact: