Smart Saving Strategies for Millennials and Gen Z

Learn smart ways to save and grow your wealth in your 20s and 30s when you think you don’t have any money to put aside

If the pandemic taught us anything, it’s that no one can predict the future. The only certainty is change. And, while we all know that taking care of our physical and mental health during times of uncertainty is crucial, what about our financial health? Paying attention to our financial well-being can also bring peace of mind.

The epicenter of our financial health is not spending power or earning power, but rather savings power. But, when you don’t have a lot of extra money each month, where should you begin? Here are a few simple savings strategies you can implement no matter your background or income level.

Invest In You

This is a concept you’ve certainly heard before, but do you do it? It can be challenging to not get the instant gratification of other purchases, but paying yourself first will pay off – literally!

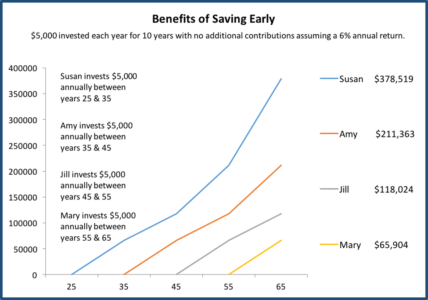

First, it’s important to understand why it makes sense to start saving early. Here is an example showing the benefit of starting your savings plan now. The chart below shows four women, all who save $5,000 a year for ten years (for a total investment of $50,000 each), earning an annual 6% return. Susan begins to invest at age 25 and has $378,519 when she retires at age 65. Mary, on the other hand, decides that retirement is too far off in the future and doesn’t start saving until she is 55 years old. When she retires at age 65, she will have only $65,904 saved.

The most important takeaway is this—while Susan and Mary invest the same amount of money over time, Susan’s balance at retirement is much higher due to the extra years of compounding (earning on your previous earnings).

Now that you understand why you should start to save when you’re in your 20s and 30s, let’s find some money to deploy to savings.

Reclaim Autopay

One of the most powerful tools in financial literacy is simply reviewing your bank and credit card statements. Go through them monthly. You can easily save money just by checking for auto charges or subscriptions you forgot about or no longer use. Many companies auto-debt your account – make sure you are aware of which ones they are, and that you still desire the service they provide. Common oversights are memberships, apps, and streaming services. iPhone user can also check “subscriptions” under settings to make sure the list you see is only what you intend to continue using.

It’s also important to remember to pay your bills on time to avoid incurring interest payments and late charges.

Create a Budget

Now that you know where your money is going, determine how much you can save. Make a monthly budget with income and expenses and include an amount for savings. Set up automatic transfers to an investment account so that saving is done automatically. Another option to save for shorter-term needs is to open an online high yield savings account. Many institutions offer high yield accounts that can easily be linked to your bank account. If you make monthly contributions, even at a small dollar amount, it will add up over time.

Take Advantage of Free Money

Most employers offer some type of match when you save a portion of your salary in their 401(k) or other company-sponsored retirement account. This is free money—an annual bonus without the review!

Let’s say you make $60,000 a year, and your company agrees to match 100% of your contribution up to 3% of your salary. If you contribute $150 per month which works out to be $1,800 per year, your company will also contribute $1,800 to your retirement account. Where else can you earn 100% on your investment without taking any risk?

If you start to make these small changes in your 20s and 30s and use the advantage of time, your savings will grow, empowering you to achieve your financial goals and feel proud of yourself while doing so.