Bitcoin ETPs – Approved But Not Endorsed

On January 10th, the Securities and Exchange Commission (SEC) finally approved ten spot-bitcoin exchange traded products (ETPs), after more than five years of denying approvals. Suggesting that their approval was reluctant is an understatement as the SEC was forced to relent by the courts. Indeed, the SEC’s accompanying press release noted that “bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion, and terrorist financing.” They went further by explicitly stating that the SEC “did not approve or endorse bitcoin.”

Crypto bulls cheered, anticipating the decision would attract a wider array of investors, including greater institutional participation, to the asset class. Until now, investors needed to open accounts at specialized custodians, rely on derivative products, or invest in a closed-end fund suffering significant performance disparities between its share price and the underlying asset for exposure. While we withhold judgment on the merits of the asset class for now, we agree that the new products offer a more convenient access point with lower tracking error.

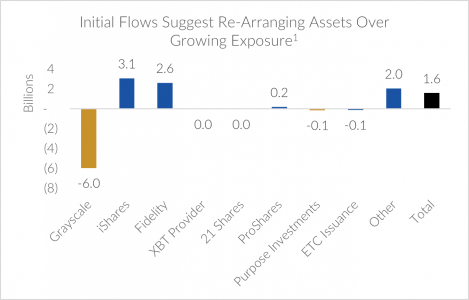

Early flows into the newly approved products suggest that it has been more about redividing the pie than growing it. Through February 3rd, more than $7.7 billion have flowed into crypto ETPs, which has offset the nearly $6 billion in flows out of Grayscale’s legacy fund[1]. This net $1.6 billion of inflows reflects just a 3% increase in bitcoin-related fund assets since the beginning of the year. Bitcoin’s price, which has changed little since the start of the year, tells a similar story. Indeed, some of the ETP’s inflows have likely come from individuals holding the asset directly. However, we acknowledge that crypto investing is simply too volatile to focus on a single month’s price action or fund flows to gauge its long-term success.

Many have compared the launch of crypto ETPs to the first spot-gold funds in hopes that it would trigger an end to the so-called crypto winter. We are not so certain. When the first gold ETP launched in 2003, the price of gold soared in subsequent years. Transaction costs collapsed as investors no longer needed to source, transport, and store the physical commodity. It’s unclear that Bitcoin is pre-destined for the same fate. Indeed, transaction costs were already relatively de minimis. Certainly, the ETPs make it easier to purchase crypto; however, the relative improvement of the cost of ownership is undeniably lower than for gold.

For those considering investing in Bitcoin ETPs, we believe there are a few critical criteria to consider when choosing the provider.

- Security concerns – Partnering with reputable managers who have the resources and expertise to adequately secure the underlying bitcoin and provide safeguards for its transfer is vital.

- Fund size – For passive products, there are benefits to being in larger funds. Higher asset levels and average trading volumes tend to lead to lower bid/ask spreads and tracking error.

- Fees – For long-term taxable investors, we recommend looking past the teaser expense ratios. If the underlying asset appreciates, the tax consequence of trading to a cheaper expense ratio may be prohibitive later.

In our view, the mere presence of the exchange-traded products does not fundamentally change the investment thesis. We believe Bitcoin’s long-term success or failure will be determined by the merits of the underlying asset rather than by how it’s accessed. Proponents offer unsustainable government fiscal policies, increased usage in emerging economies, and a desire for a more efficient and decentralized transaction platform as secular forces that will drive the value of cryptocurrencies higher. Detractors point to the price volatility of the asset class since its inception as an impediment to its ever being accepted as a long-term store of value and its high recent correlations to tech stocks and Fed rate expectations as faults in its diversification properties. We prefer not to deal in absolutes and will keep an open mind when exploring crypto’s investment case.

[1] Coinshares Digital Asset Fund Flows, 02/05/2024