Investing with Values: Q2 2022

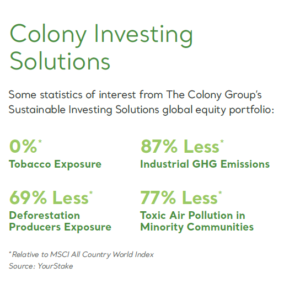

Investment managers focused on sustainability and impact often incorporate environmental social and governance (ESG) criteria into their process, but are the “E” and the “S” truly discrete? Environmental and social issues are often not distinct categories but, like concentric circles, they frequently overlap. Many sustainable fund managers have long recognized the inextricable links between climate change and social inequities. Now policymakers are starting to embrace these connections as well. As investors begin to understand the true social costs of environmental risks, they will further appreciate the scope of their impact from integrating sustainable objectives into their portfolios. We use air pollution and deforestation to illustrate the relationship between environmental and social issues.

Air Pollution

While the US has made great progress since the passage of the Clean Air Act in 1970, the American Lung Association’s recent 2022 “State of the Air” report concluded that 4 out of 10 Americans live in areas with unhealthy levels of particle pollution or ozone. In addition, the study found that during the three-year period of the report, Americans experienced more days of “very unhealthy” or “hazardous” air quality – the highest incidence in the two-decade history of the publication.

However, the effects of air pollution are distributed unevenly which may exacerbate inequities related to health, jobs, investment, and education. Many studies have shown that communities of color are disproportionately impacted by air pollution. A recent study concluded that average PM2.5 exposure from all anthropogenic sources is approximately 14% higher for people of color and 21% for blacks.1 Furthermore, the study found that disparities result from nearly all major emission sources and exist at all income levels, suggesting the impacts are systemic.

Furthermore, evidence points towards the psychological impacts from air pollution. Recent studies have demonstrated a link between air pollution and reduced cognitive ability and workplace productivity and increased incidence of mental disorders and criminal behavior. The uneven burden of air pollution combined with its broad range of effects suggest its social costs may be underappreciated.

These challenges were not lost on the Biden administration during the design of the recently passed Inflation Reduction Act. The package includes $60 billion for environmental justice priorities aimed at helping economically disadvantaged communities struggling with pollution and health disparities. Specific initiatives include efforts aimed at reducing pollution in port communities, improving transportation and air quality more broadly, and investing in clean energy and sustainability projects that focus on disadvantaged communities.

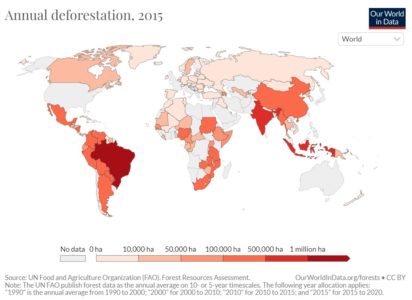

Deforestation

Forests are vital components of our carbon and water cycles. When they are lost or degraded, ecosystems are changed, sometimes permanently. The World Wildlife Federation estimates that the Amazon Rainforest has been reduced by 17% over the last 50 years. Other parts of the world, such as the Congo Basin, Eastern Australia, and several spots within Southeast Asia, are also experiencing rapid loss of forests. Much of this is due to agriculture, illegal logging, cattle ranching, and palm oil plantations.

The environmental effects are well-documented. Forests act as a carbon sponge, soaking up carbon dioxide that would otherwise be released into the atmosphere. The social and human health effects are also significant. Approximately 1.25 billion people rely on forests for shelter, fuel, and food security. Moreover, 750 million people, including 60 million indigenous people, live in forests. For many, deforestation or forest degradation has resulted in the loss of livelihood, food insecurity, reduced migration, and conflict. Conflict may occur between communities and companies over land rights, between communities and non-native workers, or even within communities. Forced labor, child labor, and trafficking have been identified in areas of Southeast Asia.

Additionally, the loss of biodiversity may be increasing the frequency of zoonotic diseases and pandemics. A recent study that analyzed 6,800 ecological communities across 6 continents suggests there is a direct link between biodiversity loss and disease outbreaks.2 As human activity encroaches more on wildlife habitats, the proximity of humans to animals carrying pathogens only decreases. In addition, the species that are more resilient to extinction are often those carrying the most pathogens.

Sustainable fund managers understand the links between environmental and social risks and have engaged successfully with companies to address these risks in their supply chains. Through their active ownership, Green Century Funds has convinced major palm oil buyers like Kellogg, Starbucks, JM Smucker, and Target to make zero-deforestation commitments. Due to the efforts of Green Century and other sustainable fund managers, the percentage of palm oil refineries in Southeast Asia covered by deforestation agreements increased from 5% in 2012 to 83% in 2020. Pax World Funds’ ESG research process measures environmental and social risks as one pillar. In their 2022 Engagement and Policy advocacy report, Impax Asset Management (adviser to the Pax World Funds) stated “progress on addressing climate change must accelerate if we are to mitigate the rising threats to environmental and social stability.”

Thematic Spotlight: Healthcare Innovation

Investing in healthcare innovation may help clients realize both societal and financial objectives. Advancements made in biotechnology, medical equipment, and diagnostics have the potential to significantly impact patient lives and provide patient investors with long-term financial rewards.

The Eventide Healthcare and Life Sciences Fund invests in companies providing innovative therapies serving unmet needs, transforming the current standard of care, and providing positive long-term impact on patient lives. Areas of focus include rare, infectious, and autoimmune diseases, cardiovascular ailments, and neurology. Eventide will only invest in companies it believes are ethical and sustainable. The firm has developed a holistic framework to evaluate a company’s potential long-term competitive advantage, societal impact, and interaction with key stakeholder groups.

Investors should note that while a portfolio of early-stage, developmental life science companies may provide attractive long-term returns, the fund should exhibit substantial volatility. The fund is suitable for long-term investors who value impact and innovation and have a high tolerance for risk.

For more on Sustainable Investing Solutions, read our Sustainable Investing Primer or our recent article in Worth magazine on thematic investing.

Download the PDF version by clicking on the image below.