The First Hikes Were The Deepest

Throughout time, many investors considered bonds to be relatively boring. Their contractually obligated interest payments made returns easy to forecast for investors that held to maturity. Then 2022 happened. While the bonds continued to pay their promised cash flows, the Fed’s interest rate policy, designed to cool the economy, made short-term treasury yields more attractive. The resulting price declines and increased volatility turned the usually sleepy asset class into the center of the storm. Despite this monetary tightening, the economy has remained remarkably resilient. Fed Chair Jay Powell recently told Congress that if the Fed does not see further progress soon, it may need to hold rates at higher levels for longer. The Fed’s vigilance has bond investors wondering whether they should brace for another challenging year. In short, we believe that the answer is no.

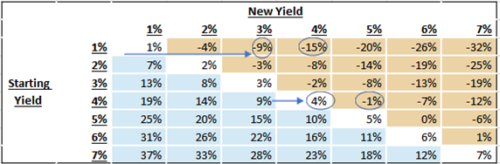

Starting yields provide a natural cushion to forward bond returns. Whereas last year started with yields near 1%, today, yields are closer to 4%. Last year’s 3% move higher in yields caused many bond portfolios to lose approximately 15%. Today, with yields starting at 4%, a jump in yields should be much less painful (see table below).

Figure 1: 1-Year Simulation

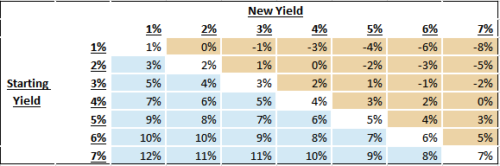

Indeed, a 2% increase in yields results in positive returns over a three-year period. To wit, if yields were to instantaneously move upward from 4% to 6%, the additional income would more than makeup for the initial price decline.

Figure 2: 3-Year Simulation

The risk-reward profile is more balanced today. Certainly, the probability for more meaningful bond returns has improved markedly. Coming into 2022, yields had very little room to fall given the Fed’s reluctance to push them into negative territory. If economic conditions deteriorate, the Fed now has the option of interest rate cuts, causing immediate rewards for bond investors. To be clear, we do not believe that a return to pre-pandemic interest rate levels is likely, but more modest moves downward might. Even a 1% decline in rates (and the associated 9% return) could be a useful counterbalance in a portfolio.

With the recent slowdown in rate increases, the Fed is transitioning from catch-up mode to calibration mode. In retrospect, the Fed fell behind in its inflation fight after “not thinking about thinking about” raising interest rates for too long. As a result, they were forced to hike rates at an accelerating pace in an attempt to catch up with inflation. We believe 2023 should see more modest moves. The current Fed Funds rate is well above their long-term targets and 1-2% below the level the Fed believes is needed to fully quash inflation. In our opinion, that’s likely to result in fewer rate shocks in favor of more modest adjustments. Notably, in the tables above, we assume that the entirety of an interest rate move is made in one meeting; however, if delivered in a series of 0.25% or 0.50% adjustments throughout the year, the investment experience would be much smoother.

While last year left a poor taste in the mouth of fixed-income investors, we believe the outlook for bonds is more balanced today than at any time in the last decade. Higher starting yields, greater diversification benefits, and more deliberate changes to interest rate policy present an opportunity for the traditional 60% equity / 40% bond portfolio to return to its past glory. Boring just might be beautiful again.