Tips for Young Adults on Saving for Retirement Early

Smart strategies for teens and young professionals on saving for retirement early to position yourself for financial independence later in life.

The importance of starting early

For students earning minimum wage at their first job or young professionals experiencing the first paycheck of their new career, there are likely more interesting prospects when deciding how to spend your hard-earned money than saving for 40-50+ years down the road. While prioritizing retirement savings may sound unnecessary for those in their teens or twenties, there is no better time to begin saving for retirement than as early as possible.

New research from the Milken Institute finds that the latest age Americans should begin saving for retirement is 25. While this may seem young, compounding interest can help your assets grow by the time you hit retirement age, so it is optimal to begin as soon as possible. With compounding interest, your original savings are invested as well as the returns earned on your original savings. This reinvestment can have a large impact on your total savings throughout life and also help to avoid a scenario as you near retirement where you need to save a significantly higher portion of your earnings than if you had started earlier. The Milken Institute notes the following example:

- A 25-year-old who saves $100 per week and receives a 7% annual return on investment will have $1.1 million in retirement savings at 65.

- A 35-year-old who begins saving the same amount and earning the same annual return will have $300,000 in retirement savings at 65.

Compounding returns are powerful. Younger generations including Millennials and Gen Z are likely to benefit from this concept more than past generations. Millennials began saving for retirement at age 25 and Gen Z at 19 compared to Baby Boomers and Gen X which began saving for retirement at a median age of 35 and 30, respectively. The above example demonstrates how powerful these extra years can be for today’s young adults, if you know how to take advantage of them.

How to begin saving

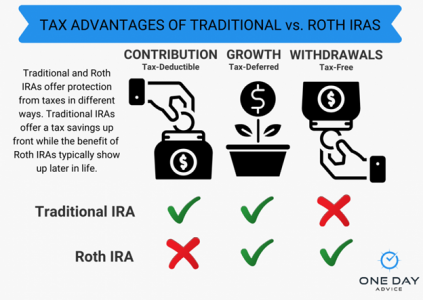

Before you are a full-time employee that may have access to an employer-sponsored retirement plan, you can still contribute to Individual Retirement Accounts (IRAs), even if you are only working part-time. The two main types of IRAs are Traditional IRAs and Roth IRAs. While you are able to open both, a Roth IRA is an excellent option for a first retirement account for young adults given it allows you to contribute after-tax dollars and offers tax-free growth and tax-free withdrawals in retirement. Teens and young adults are likely to be at a lower tax bracket than in retirement, so it can be beneficial to pay the taxes today and invest these after-tax dollars in your Roth IRA.

Here are the key points to know about Roth IRAs:

- Regardless of your age, you can contribute to a Roth IRA if you meet the income requirements.

- Eligibility to make contributions to a Roth IRA each year is determined by your taxable income. For example, if you earned $1,000 in taxable income in 2023, you could only contribute $1,000 to your Roth IRA. If you did not earn taxable compensation in a contribution year, you cannot contribute to a Roth IRA.

- If you overcontribute relative to your taxable income, you may face monetary penalties which could diminish investment returns.

- For 2023, combined annual contributions between a Roth IRA and Traditional IRA cannot exceed $6,500 regardless of if your taxable compensation is higher. For 2024, the IRS increased the combined contribution limit to $7,000.

- Visit this IRS chart to determine if your Modified Adjusted Gross Income (MAGI) qualifies you to make contributions to a Roth IRA. If you surpass these income limitations at any point in life, consider opening a Traditional IRA in addition to your existing Roth IRA. A Traditional IRA has no income limitations and allows you to grow your money tax-deferred, meaning you will pay taxes on withdrawals in retirement.

- Eligibility to make contributions to a Roth IRA each year is determined by your taxable income. For example, if you earned $1,000 in taxable income in 2023, you could only contribute $1,000 to your Roth IRA. If you did not earn taxable compensation in a contribution year, you cannot contribute to a Roth IRA.

- You can contribute to an IRA anytime between January 1st of a given year and the tax-filing deadline of the following year, which is typically around April 15th.

- It may seem obvious, but many young adults do not realize that simply transferring cash to your retirement account is not enough to benefit from the power of compounding returns. Instead, you must invest the money in products such as stocks, bonds, mutual funds, or ETFs. Consult with those who you trust, such as your parents or financial advisor, for assistance in constructing an appropriate retirement portfolio.

Take advantage of employer-sponsored accounts

Once you begin your full-time career, pay attention to if your employer offers an employer-sponsored retirement plan such as a 401(k), which is generally offered by private, for-profit companies, or a 403(b), which is typically available to nonprofit/tax-exempt organizations and government employers. In addition to your existing IRA account(s), you are eligible to contribute $22,500 total per year in 2023 (the IRS increased this to $23,000 in 2024) to these employer-sponsored accounts. Your employer may even contribute a percentage of your salary to your retirement account or match up to a certain percentage of your personal contributions. This can significantly increase your annual retirement savings, so read carefully into what your company provides. To ensure you maximize your tax advantaged retirement savings, stay up to date on the annual IRS contribution limits, which are periodically changed.

The smart decisions you make in your young adulthood on when to begin saving for retirement and the tax-advantaged strategies you use to do so can enhance your financial independence in retirement.