What a Week! Or Not…

This week was another wild ride in the markets but we returned almost back to where we started.

Virus

Global cases have now topped 100,000 and we anticipate seeing additional increases. The CDC sent out 2,500 testing kits to health centers around the country (each kit can test approximately 800 patients). We have read through a multitude of reports from investment managers, our macro research providers, and medical professionals, and to say that their forecasts are wide-ranging would be an understatement. We will start with the negative news: it’s clear that the virus is spreading to other countries, including the US. In the US, there are at least 250 cases across 23 states. It is likely that this is only the tip of the iceberg. The travel industry has been significantly impacted and there are select school closures. On the positive side, there are reports that the virus’s mortality rate is declining. As more people become aware of the virus they will take precautions to help stem its spread.

Fixed Income

As we discussed in our February Update, the market was expecting a significant rate reduction from the Federal Reserve; they got it with the first emergency rate cut since the financial crisis. It was a larger than expected 50 basis point cut. The market seemed to respond with “thank you, sir, may I have another” and is now pricing in another 75 basis point cut at the March meeting. Indeed, the 3-month T-bill’s current price reflects a 50 basis points Fed Funds target. The 10-year treasury is astonishingly yielding below 1% (77 bps at the time of writing). Perhaps the most interesting part of the fixed income moves, is that we’ve actually experienced a steepening of the yield curve, suggesting that market participants are not pricing in a recession.

Equities

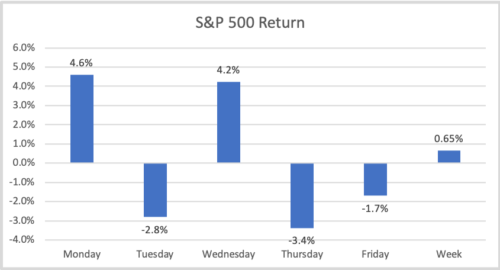

Each day of trading during the past week was extraordinary. However, despite this volatility, the weekly return was rather average. The median weekly return for the S&P 500 over the last 20 years was 0.24%. This week we experienced a 0.65% increase. We continue to see the benefits of diversification in our portfolios. While we will not have final numbers until Monday, through Thursday, international and emerging market equities continued their outperformance from last week. While many are looking for the opportunities created by the crisis, for example, Clorox wipes, pharmaceuticals, etc…, we think it’s prudent to balance risk with the expected reward by focusing on long-term trends rather than shorter-term trades. We highlighted a few examples in our February market review.

Outlook

Our view continues to be broadly constructive over the intermediate term; however, we acknowledge there may be more pain before risk assets bottom. With the extraordinary move in Treasuries this week, we are becoming increasingly more comfortable with equities when compared to fixed income. We are currently evaluating several possible trades. We believe it is not possible to accurately time the bottom so we will intend to take a measured approach to adding risk. Thus far, the wild swings in the investment markets have not exposed any systemic risks within the financial system. While the drawdowns have been sharp, we do not believe there have been significant mispricings that have necessitated immediate action. This has allowed us to be more deliberate with our decisions.