When to Start Considering High-Interest-Rate Estate Planning Strategies

In a time of rising interest rates, certain irrevocable trusts can be helpful strategies to consider when crafting your estate plan.

A Primer on Interest Rates

Each month, the IRS updates and publishes what estate and financial planning practitioners call the Section 7520 interest rate (the “7520 Rate”). This rate generally increases with each interest rate hike by the Federal Reserve.

Certain estate and gift tax planning strategies incorporate the 7520 Rate in formulas as the assumed growth rate, or the discount rate for the present value of an annuity or a remainder interest (that is, a future interest).

During periods in which the 7520 Rate is higher, some of these strategies become increasingly attractive. For example, because a higher discount rate produces a lower present value of a remainder interest, those transferring wealth under the strategies discussed below can report the present value of the remainder interest on their gift tax return using a lower present value, yielding a lower gift tax.

Let’s review each strategy.

Qualified Personal Residence Trust (“QPRT”):

- A QPRT is an irrevocable grantor trust where a person (“grantor”) contributes their personal residence to the trust and retains the right to live in the home rent-free for a fixed period (the “QPRT term”). After the QPRT term, homeownership passes to remainder beneficiaries (or trusts for beneficiaries).

- The present value of the home after the QPRT term (the remainder interest) is a taxable gift. The grantor files a gift tax return for the year of the QPRT’s funding.

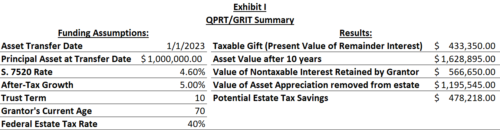

- The 7520 Rate is the discount rate used to calculate the present value of the remainder interest in the home. A higher 7520 Rate leads to a smaller remainder interest. The formula will apply the 7520 Rate in effect for the month of transfer (in Exhibit 1, the Jan. 2023 rate).

Example 1: Jane is a 70-year-old Georgia resident and homeowner, in good health with two adult children and a taxable estate. Jane’s $1,000,000 residence is in excellent condition and without a mortgage. She wants to make a gift to her children that keeps her home in the family for generations.

Jane contributes the home to a QPRT and continues to live in the residence for the QPRT term, but afterwards Jane pays rent to the remainder beneficiary to continue living in the home. The QPRT allows Jane to transfer a home with a future value of $1.6 million, while applying only $433 thousand against her lifetime estate and gift tax exemption (Exhibit 1). If Jane survives the QPRT term, the residence passes to her children with the same cost basis. If Janes does not survive the QPRT term, her estate will include the home’s value, the gift value will be restored, and Jane will not lose that portion of her estate tax credit.

Pitfalls: Mortgage payments and improvements are considered taxable gifts. The annual gift tax exclusion does not apply since the gift of the home is not a present interest. Also, after the QPRT term, the grantor must pay rent to remainder beneficiaries, who are often younger generations.

Grantor Retained Income Trusts (“GRIT”):

- A GRIT is an irrevocable trust where the grantor contributes assets and receives income from the trust for a fixed number of years. Thereafter, the remaining principal passes to beneficiaries.

- QPRTs and GRITs apply similar methods to calculate the value of the taxable gift – the taxable gift is the value of the remainder interest, which is the amount contributed to the GRIT less the grantor’s retained income interest.

- The higher the 7520 Rate, the lower the remainder interest.

Example 2: Isaac is a 70-year-old retired widower without children, but he has a large extended family. He is in good health and has a taxable estate. Isaac wants to establish a trust for his nieces and receive income. Applying assumptions identical to Example 1, the present value of Isaac’s income stream is approximately $566 thousand, while he gifts $1 million of property for a taxable gift value of about $433K. If Isaac survives the term, the appreciated assets pass to the beneficiaries with Isaac’s cost basis.

Pitfalls: The IRS disallows naming immediate members of the grantor’s family as GRIT beneficiaries. This includes the grantor’s spouse, parents or spouse’s parents, children or children’s spouses and siblings or spouse’s siblings (or their spouses). A GRIT should be considered when desiring to assist extended family members, unmarried partners, or a former spouse.

Charitable Remainder Annuity Trust (“CRAT”):

- A person contributes property to an irrevocable trust that pays an annual annuity to non-charitable beneficiaries (which can include the grantor) for a certain period (the “annuity period”). The annuity period can last up to 20-years or the lifetime of the non-charitable beneficiary.

- After the annuity period, the CRAT distributes the remaining trust property to a qualified U.S. charity.

- The grantor receives a charitable income tax deduction of the present value of the charitable beneficiary’s remainder interest.

- The CRAT may sell the property contributed without tax liability; however, the character of taxes realized flows to the annuitant with each payment.

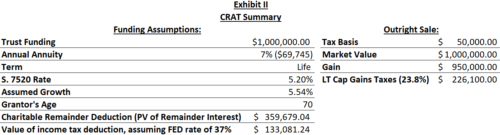

- The 7520 Rate acts as the CRAT’s assumed earnings rate. A higher 7520 Rate suggests greater earnings, and a larger benefit passes to the remainder charity, resulting in a larger deduction. The donor can use the 7520 Rate from the month of transfer or either of the prior two months, whichever is more favorable.

Example 3: John bought $50,000 of Apple stock in January 2007. That investment has grown to $1,000,000, representing a built-in $950 thousand long-term capital gain. John is nearing retirement and needs to diversify his holdings and receive additional predictable income. John also wants to assist a local non-profit.

John will use the December 2022 AFR of 5.2%, which is higher than January 2023’s 7520 rate of 4.6%. As shown in Exhibit II, John can claim a roughly $359,000 income tax deduction in the year of funding the CRAT and defer $229,000 of long-term capital gain taxes into the future, as he pays taxes only when he receives annuity payments. A 7% annuity rate is an approximate $69,000 annual payment to John.

Pitfalls: The grantor should partner with a trusted advisor to oversee funding and administration. Annuity payments stop at the death of the non-charitable beneficiary. If the non-charitable beneficiary’s family members rely on the annuity payment, consider life insurance as income replacement in the event of the non-charitable beneficiary’s pre-mature death. There is no income tax deduction if the CRAT fails to meet IRS benchmarks governing the probability of asset depletion and the value of the charity’s remainder interest.

Conclusion:

These strategies are meant to enhance a wealth transfer plan and not to replace existing strategies and goals. Creating and choosing the right strategy requires careful analysis of your goals, priorities, existing estate plan, and available assets.

With special thanks to The Colony Group’s Nadine Gordon Lee for her contributions and support.