Will You Take a Tax Hit When You Sell Your Home?

Many homeowners in the Washington, DC region are fortunate that their homes have appreciated in value over the years. This is especially true for those who have owned their homes for a decade or more.

While we all want our home to be worth more (hopefully, significantly more) than what we paid for it, it does raise questions about potential tax consequences when we go to sell it. In fact, one of the most frequently posed questions from our clients is, “My house is on the market – will I have to pay tax on any gain when it’s sold?”

The good news is that the tax code does provide certain tax breaks for the sale of a principal residence, based on the taxpayer qualifying for this treatment by passing a series of eligibility tests. The first step, however, is determining the actual gain or loss on the sale.

Calculating your gain or loss

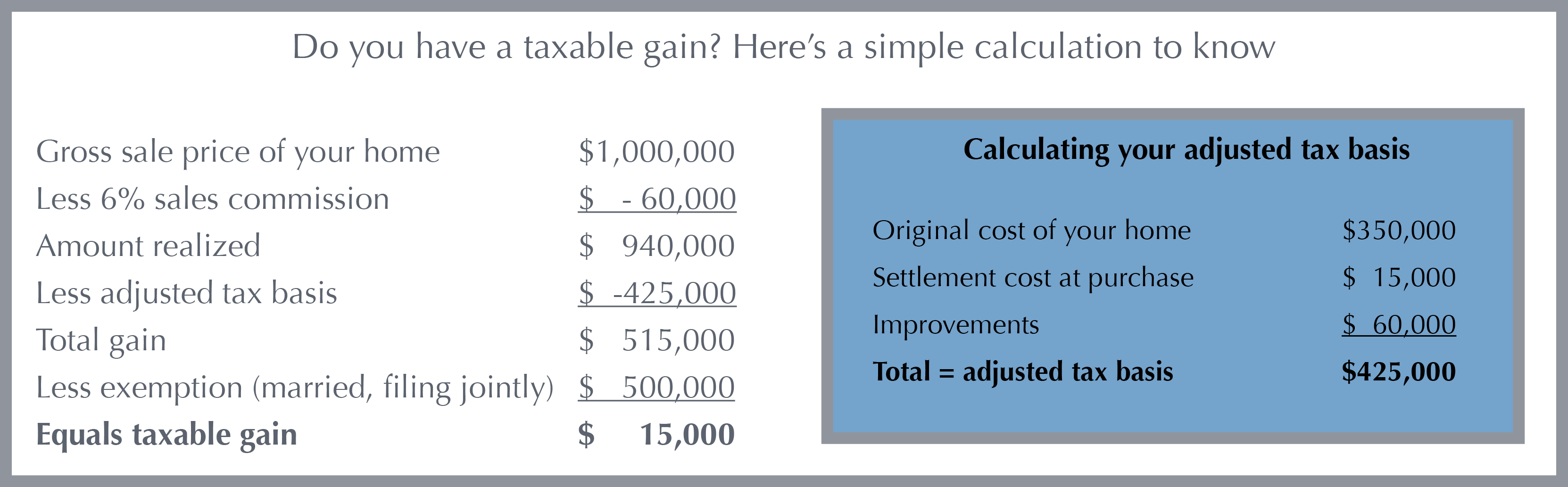

The gain or loss upon sale is the difference between the amount realized (the gross sales price less selling expenses such as the realtor commission) and the adjusted tax basis of your home. Generally, the amount realized can be easily determined by reviewing your settlement sheet, or escrow closing document. In addition to the realtor commission, certain expenses paid at settlement such as legal fees are also considered selling expenses. Other expenses paid outside of settlement, such as advertising, may also qualify.

Calculating the adjusted tax basis of the home may be a little trickier. Start with the amount you originally paid for the home, including any settlement fees or closing costs you paid at purchase. Add the cost of any improvements that were made to the home during your period of ownership and are still part of the home when you sell it. For example, if you’ve replaced the roof twice, only the most recent replacement should be included. Money that you spent over the years on ordinary repairs doesn’t qualify. The following table is an example of how to calculate your gain or loss.

Certain situations require additional calculations

In most cases, this will result in your gain or loss figure. There are a number of situations, however, that can require additional calculations to determine gain or loss. If you’ve ever used the home, or a portion of it, for business purposes an adjustment will be needed for the accumulated depreciation taken as a tax deduction. If you sold a home before 1997 and “rolled-over” the gain, this will require an adjustment to the calculation.

Gain exclusions can be tricky

If your calculations result in a gain, you may qualify for a $250,000 gain exclusion ($500,000 for married filing jointly) if you meet certain eligibility tests. You must have owned the home and used it as your primary residence for at least two of the last five years before the sale date. You may only take advantage of the exclusion once every two years – in other words you cannot have excluded a prior gain in the two year period prior to the sale of the current home. You also may not have acquired the home through a like-kind (section 1031) exchange.

Of course, there are many real-life complications that arise that don’t neatly fit into these rules. Situations like “I married recently, does my spouse also have to have lived here for two years?” “I’m moving because of my job – are there any special exceptions to the two-year rule?” “We’re getting divorced – can we still take the $500,000 exclusion?” and so on. There are situations like these in which an exception, or the possibility of a partial exclusion, may apply.

Tax consequences of gains

If you do qualify for the exclusion, it will reduce (and sometimes eliminate) your gain. Any remaining gain after the exclusion is taxed at the long-term capital gain rate of 15 to 20%, depending on your marginal tax bracket. Additionally, any taxable gain will also be subject to the Net Investment Tax of 3.8%. If you sell your home at a loss, the loss cannot be deducted from your income.

Get advice before the sale

As with many areas of tax, planning ahead can be the key to getting the most favorable results. It’s a good idea to consult with your tax advisor well in advance of the sale to eliminate unforeseen and unwelcome surprises.