Year-End Tax Planning 2020

The many challenges of 2020 have of course been exacerbated by the heightened uncertainty surrounding them. While the human challenges remain the most critical, from a financial-planning perspective, many were hoping that the 2020 elections would at least provide a clearer direction of where tax policy is headed. Instead, we are left with continued uncertainty, especially because control of the Senate is up for grabs and will not be settled until after the new year. Republicans currently hold a 50-48 advantage, but two January run-offs in Georgia will determine the balance of power in Congress.

The last few years already have seen major tax law changes through the Tax Cuts and Jobs Act (“TCJA”), the Setting Every Community Up for Retirement Enhancement (“SECURE”) Act, and, most recently, the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act. As to whether we can expect further changes, even if the Georgia Senate races are both won by the Democrats, their margin in the Senate would be razor thin. It is therefore likely, though not guaranteed, that any changes in the near future would be incremental.

As things currently stand, for most taxpayers, the general tax strategy of deferring income and accelerating deductions continues to hold true – at least for now. But for taxpayers facing major decisions around capital gains or estate-tax issues, it is important to consider the possibility that tax rates and exemption amounts could be changing significantly in the not-too-distant future.

Up is Down, Left is Right? Consider Accelerating Income.

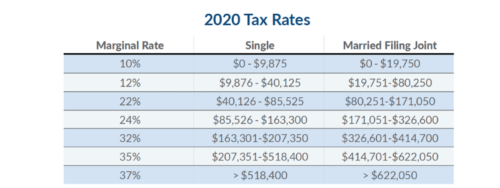

This is the rare situation where, for some, it may make sense to accelerate income if possible. Normally we preach the benefits of deferring income, and, as a general matter, we still do. Yet, the tax law in 2020 is a known quantity while the law for 2021 still faces uncertainty. For high-income earners, it is possible that tax rates will not be this low again for the foreseeable future. Biden’s plan calls for the maximum ordinary rate to be returned to the pre-TCJA level of 39.6% (from its current level of 37%). More than in recent years, it is vital to work with your advisor to evaluate your individual situation and consider the possibility of future changes to the tax laws. The following strategies will not apply to everyone, but, given the right circumstances and depending on whether and when we see any changes to the tax laws, they could offer the potential for significant tax savings.

- For business owners: Biden’s tax plan calls for raising the maximum capital gains rate from 20% to 39.6% for taxpayers with income over $1 million. Taxpayers who are currently selling businesses should consider the risks of not finalizing their sales before the end of the year.

- For those with RMDs: The CARES Act waived required minimum distributions (RMDs) for 2020. Taxpayers over 70 ½ (72 for taxpayers who attain age 70 ½ after December 31, 2019) may have significantly lower income this year because they have no RMDs. This could be a good opportunity to realize long-term capital gains at low tax rates.

- For those with traditional IRAs: A Roth conversion is one of the most common ways of accelerating income. Converting a traditional IRA into a Roth IRA means that the taxable IRA balance is taxed now at ordinary rates, which may or may not make sense for a particular taxpayer. But if converted into a Roth IRA, the funds in question receive the double benefit of growing tax-free and not triggering taxes upon distribution at a later date.

- For those with stock options: Exercising options is another way to fill in tax brackets to lock in the current marginal rates. Nonqualified stock options, for example, generate compensation income equal to the fair market value of the shares less the exercise price when exercised. If 2020 has been a low-income year, exercising options before the end of the year may make sense.

Up is Still Up. Continue to Accelerate Deductions.

The TCJA nearly doubled the standard deduction when it was passed back in 2017. For 2020, the basic standard deduction allowances are $12,400 if you are single and $24,800 if you are married and file jointly. In order to receive a benefit from itemizing, your total itemized deductions must exceed the standard deduction threshold. Many taxpayers will easily hit the full $10,000 allowance for state and property tax deductions. For those without a large mortgage interest deduction, the challenge then is to efficiently bridge the gap between that $10,000 and the new standard deduction threshold. A common way to do this is to bunch medical and charitable deductions into one year if possible. Setting up a donor advised fund is a great way to bunch several years of charitable tax deductions into 2020 while still controlling the timing of the contributions to individual charities.

But if tax rates do go up in 2021, won’t your allowable deductions be more valuable next year? The answer is yes, assuming nothing else changes, but we note that Biden’s tax plan proposes limiting the value of itemized deductions to 28%. Under the current rules, if a taxpayer over the itemizing threshold in the highest bracket contributes $10,000 to charity, the value of the deduction would be $3,700. Under the Biden plan, that deduction would be limited to $2,800. This proposed change would only affect taxpayers in tax brackets greater than 28% and, of course, may or may not be implemented in 2021.

Charitable Giving: This year also has some other unique opportunities to consider:

- For 2020 only, the CARES Act allows for a charitable deduction of up to $300 for taxpayers who do not itemize. Normally charitable contributions can only be deducted by taxpayers who itemize.

- The CARES Act also temporally raised the Adjusted Gross Income (“AGI”) cap on charitable gifts made with cash. Cash contributions were previously limited to 60% of AGI, but for 2020 taxpayers can give up to 100% of their AGI. Please be aware this is for cash gifts made directly to qualified charities.

- While RMDs have been suspended for 2020, taxpayers can still make Qualified Charitable Distributions (“QCD”s) of up to $100,000 from IRAs. Because RMDs have been suspended, a QCD in 2020 will not reduce taxable income. Making a larger gift in 2021 will reduce taxable RMDs, which potentially could be subject to higher tax rates. But taxpayers who support charities that rely on annual contributions still have the option of making a QCD this year even with the RMD requirement waiver.

Planning for Future Generations

The lifetime federal estate and gift tax exemption is $11,580,000 for 2020. With careful planning, a married couple can keep just over $23 million exempt from federal estate and gift taxes. The current estate and gift tax exemption amounts are scheduled to sunset on December 31, 2025. If nothing changes before then, the exemption amounts will revert to $5 million (indexed for inflation) per individual. Biden’s tax plan seeks to lower the individual lifetime exemption to $3.5 million, potentially as early as 2021 Additionally, Biden has proposed eliminating the current “step up” in basis on inherited assets, though it has not been decided how this would be accomplished. One option is that beneficiaries would inherit the decedent’s basis. Another option is that the gains would be taxed at death. Taxpayers who have already used over $3.5 million of their lifetime exemption should speak with an advisor before year end to review their estate plan.

- Reduce your taxable estate: The annual gift exclusion for 2020 is $15,000 per person ($30,000 for a married couple). These gifts are a great way to reduce your taxable estate without eating into your lifetime estate and gift tax exclusion. You can also pay an unlimited amount of medical expenses or tuition payments directly to an institution on behalf of family members without eating into your lifetime exemption.

- Contribute to a 529 Education Plan: You may be able to contribute up to $75,000 per person ($150,000 per married couple) to a 529 Education Plan without eating into your lifetime exemption. 529 Plans are even more flexible now that $10,000 per year can be used to pay for K-12 tuition. Be aware that not every state has conformed with the federal rules, so a K-12 distribution may still be taxable at the state level.

- Consider a Charitable Lead Annuity Trust: Current interest rates are at historic lows. This sets up some unique tax planning opportunities using trusts. A Charitable Lead Annuity Trust, for example, may provide an attractive opportunity to make a charitable contribution while also shifting wealth to future generations.

- Provide for your spouse: Spousal Living Access Trusts provide a way for married couples to retain the use of marital assets upon the death of one spouse while also excluding the assets from the surviving spouse’s estate. It is important that the trusts are drafted properly to achieve the desired goals, as the rules around these trusts are complex.

- Know the rules for Inherited IRAs: The SECURE Act changed the rules on “stretch IRAs.” Inherited IRAs (from someone other than a spouse) must now be fully withdrawn within 10 years. Under the old rules, when considering which assets to preserve to pass on to your heirs, it made sense to preserve the IRA over most others. Now it is worth considering making a Roth conversion which, for now, are eligible to receive a step-up in basis on death.

This is a unique year, and it is important to remember that each taxpayer has different circumstances. You should contact your wealth or tax advisor to develop an appropriate plan tailored to your individual situation.