How One Day Can Make a Big Difference in Your Investment Performance

If you are like most investors, you probably review your quarterly performance report as one way to track your personal financial progress. These reports are valuable as they can give you a sense of whether you’re on course to meet your financial goals. That’s good.

The problem comes when your performance report delivers the bad news that your portfolio is down for the past quarter or several quarters. You may begin to question why you are holding investments that are dragging down your returns or your entire investment strategy.

Before making any drastic changes to your portfolio based on this report, let’s understand what these numbers mean and what they actually tell us.

What do the numbers really mean?

Like a budget, your performance report provides your investment return information based on moments in time—from a beginning date to an end date. These are typically derived from very familiar reporting periods like the beginning and ending values of a quarter, since inception (when you first purchased the investment), year-to-date, etc.

While the intention of the closing price is to indicate the most up-to-date value of a security on a particular day, it may not reflect the range of prices paid for the investment throughout the quarter or even on that specific day because many investments are traded in after-hours markets. To further complicate matters, prices are influenced by a myriad of market, economic and governmental factors which are challenging, at best, to predict. Yet, it is just such closing prices that are used to determine the value of your investments and the portfolio’s reported performance.

Since the inherent problem with portfolio review reports is that they only reflect returns in these pre-determined timeframes, what happens if we move the ending date just a few days? The difference can make all the difference!

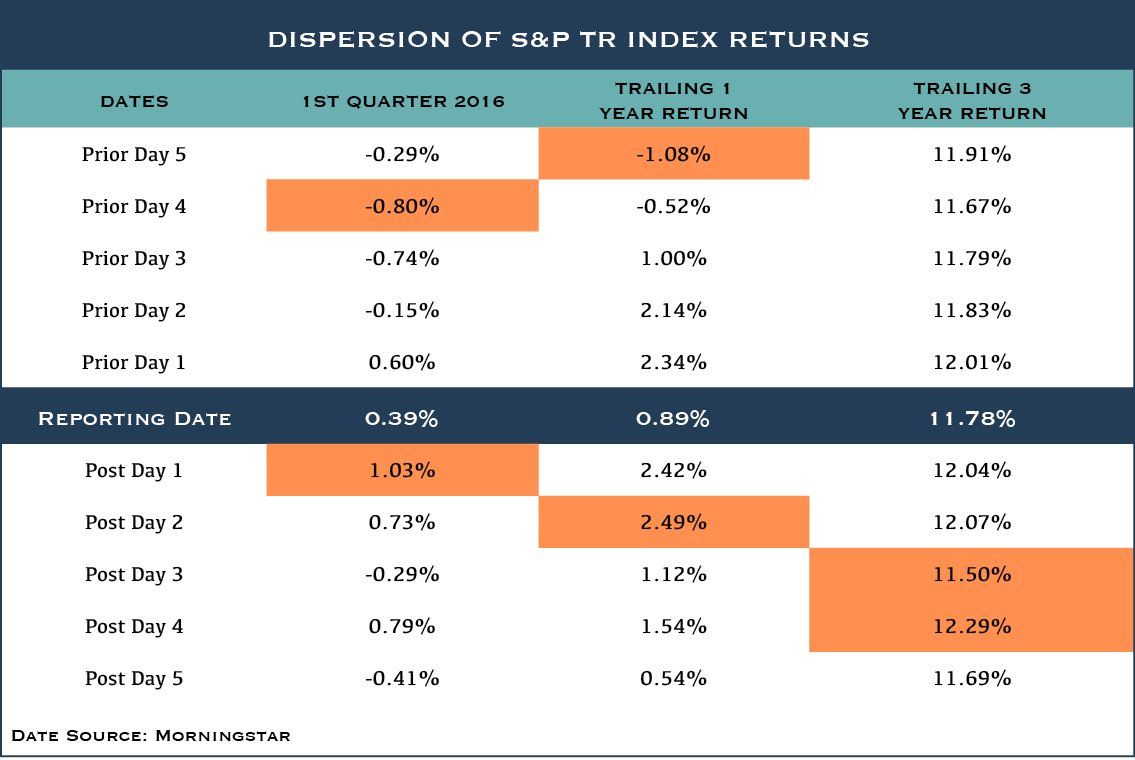

We analyzed returns for the S&P 500 Index starting with the close of the first quarter in 2016. The following chart shows that the S&P 500 Index ended the quarter on March 31, 2016 up 0.39%. That’s not bad considering it was down 5.07% in January.

The AHA Moment!

Then we kept the beginning date the same (the ending value on December 31, 2015), but moved the reporting cutoff date by five days on either side of the March 31 close. The returns for the same index varied from being down 0.80% to being up 1.03% depending on the ending day.

Now, just imagine opening your performance report to find that your return for the last 12 months was up almost 2.5% instead of being down just over 1%. That’s the variance in return for the five neighboring days before and after the conventional reporting date of March 31.

The point is that if we move the closing date just a few days, the results can impact whether you feel good or bad about your investment strategy. And basing your investment decisions on you how you feel at a given time is never a good idea.

Longer timeframes tell a more accurate story

If we go out a bit further and look at the trailing 3 year returns, they were significantly more positive and had much lower variability ranging from 11.50% to 12.29%. This lower volatility of returns is most likely because the ten-day timeframe was a smaller percentage of the overall three-year return period. This is precisely why we suggest looking at longer-term results when making investment decisions.

So, should you change course based on your portfolio review report?

Investment decisions and answering the natural questions of “Should I buy or sell? Do we need to change course? Am I still on plan?” require more information than a performance report can provide and should not be made based on more variable short-term returns.

To know if you are still on track, your performance report is just one factor to consider. And when you do, look at your longer-term returns which provide a more accurate picture of how you are doing. It’s also a good idea to talk regularly with your financial advisor. It’s their job to help you know all of your financial numbers, not just portfolio returns. Then you can better assess if you are on track and whether you need to make changes to your overall investment strategy.